Probate

Comprehensive Help With Probate Law and Estate AdministrationProbate Attorneys

Probate Attorneys and Estate Administration Throughout Los Angeles and Orange County

Offices in Los Angeles -Torrance – Long Beach – Pasadena – Costa Mesa

What is Probate?

Probate is the legal process used to transfer title to assets upon death. The Superior Court supervises the payment of debts, taxes, and probate fees. The Court also resolves all claims against the estate and distributes the deceased person’s property, either according to a valid Will or by statutory rules (known as “Intestacy Rules”) in the absence of a Will.

How We Help

We represent executors and administrators of an estate who require appointment by a Probate Court. Once appointed, we can work closely with you to:

- Publish your estate

- Bond your estate

- Protect your assets during the probate process

- Collect and inventory your assets

- Help value your assets

- Pay debts, taxes, and expenses of the estate

- Address beneficiary questions and concerns

- Resolve disputes

- Give notice to creditors

- Resolve creditor claims

- Sell real property

- File an accounting with the court

- Make final distribution of the assets

The Cost

The most common misconception about Probate is that if you have a Will, you do not have to go through the Probate process. This is the exact opposite of how Probate works! A Will, by definition, must go through Probate. The Probate Court rules on the validity of a deceased person’s Will, interprets the instructions of the deceased, appoints an executor or personal representative of the estate, and then decides the interests of heirs and other parties who may have claims against the estate.

The Probate process has many pitfalls which can only be avoided with the help qualified Probate attorney. A simple Probate, without any complications, will still take approximately nine months to one year to be completed. However, if there are mistakes or complications, a Probate can be delayed up to three or more years, depending on the severity of the mistake or the degree of complication. Delays in the Probate system have been further compounded by budget cutbacks, which have strained the court system’s resources and reduced the available number of Probate courts from twelve down to a single court in Downtown Los Angeles.

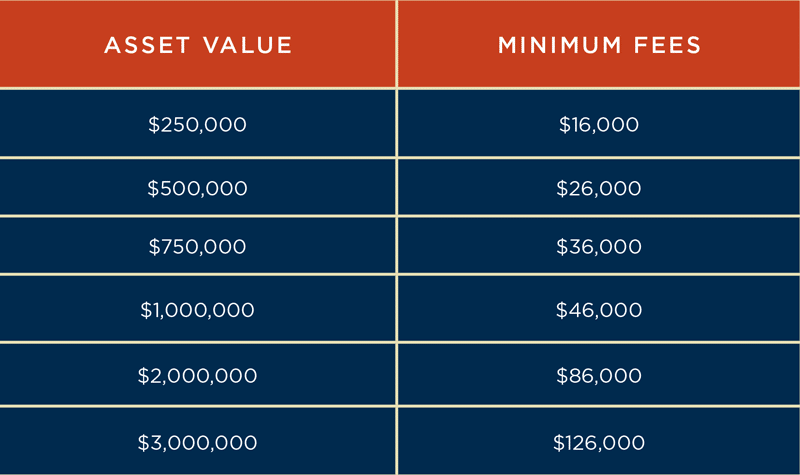

Probate is necessary when an individual dies owning assets exceeding $166,250 in his/her name. California’s probate fees, set by law, are about average among the states. The fees to settle in court (listed below) do not include special fees for the sale of assets, tax preparation, and litigation.

The approximate cost for probating an estate

Avoid Pitfalls and Costly Mistakes

Our team of Probate Attorneys can help you avoid those time-consuming pitfalls and mistakes, and make sure that your case gets through the Probate court as quickly as possible. Our Probate team is headed up by Samuel Ledwitz, who is a Certified Specialist in Estate Planning, Trust and Probate Law by the State Bar of California Board of Legal Specialization. Less than one percent of all attorneys in California are certified Probate specialists.

California’s Probate Code

Practice Areas

Estate Planning

Estate planning is the process of establishing a Trust, Will, Durable Power of Attorney, and other related documents during your lifetime.

Estate Administration

Probate

Probate is the legal proceeding supervised by the Superior Court used to transfer title to assets when a person is deceased.

Estate Litigation

Advanced Estate Planning

Families with substantial estates require additional strategies beyond a typical Estate Plan to reduce and offset Estate Tax liabilities.

Conservatorship

Our Locations

The quickest way to get assistance is to contact us directly at 310-316-2400 or by emailing us at info@ledwitzlaw.com.

Life Events

New Families

Nearing Retirement

Recent Loss

Recent Blogs

Digital Assets and Estate Planning

When estate planning for digital assets, it’s important to consider the following: Identify what digital assets you have: This includes social media accounts, email accounts, online banking and investment accounts, and any other digital assets that may have financial or sentimental value.

Determine who will have access to the assets:

Can a Single Person create a Revocable Living Trust?

Yes. A single person can create a Revocable Living Trust. The more important question is “Should a Single Person create a Revocable Living Trust?” The answer to that is also a resounding, YES! In fact, it is much more important for a single person to...

WHAT IS “ASSISTED” LIVING?

As we, our parents and relatives age, their ability to live independently eventually becomes unsafe, unrealistic—or both. One option in having them avoid the very real possibilities of household accidents and injuries can be found in convincing our elder loved ones to...

Client Reviews

As Seen in...

Awards, Certifications and Accolades